How to calculate net salary in 2026

If you’ve ever looked at your employment contract and asked yourself,

“Why am I making less than what’s written?” ,

you’re not alone.

In Italy, the gross salary (RAL) is not what you receive each month. In this article we explain, in a simple and clear way , how the net salary is calculated and what really happens to your money.

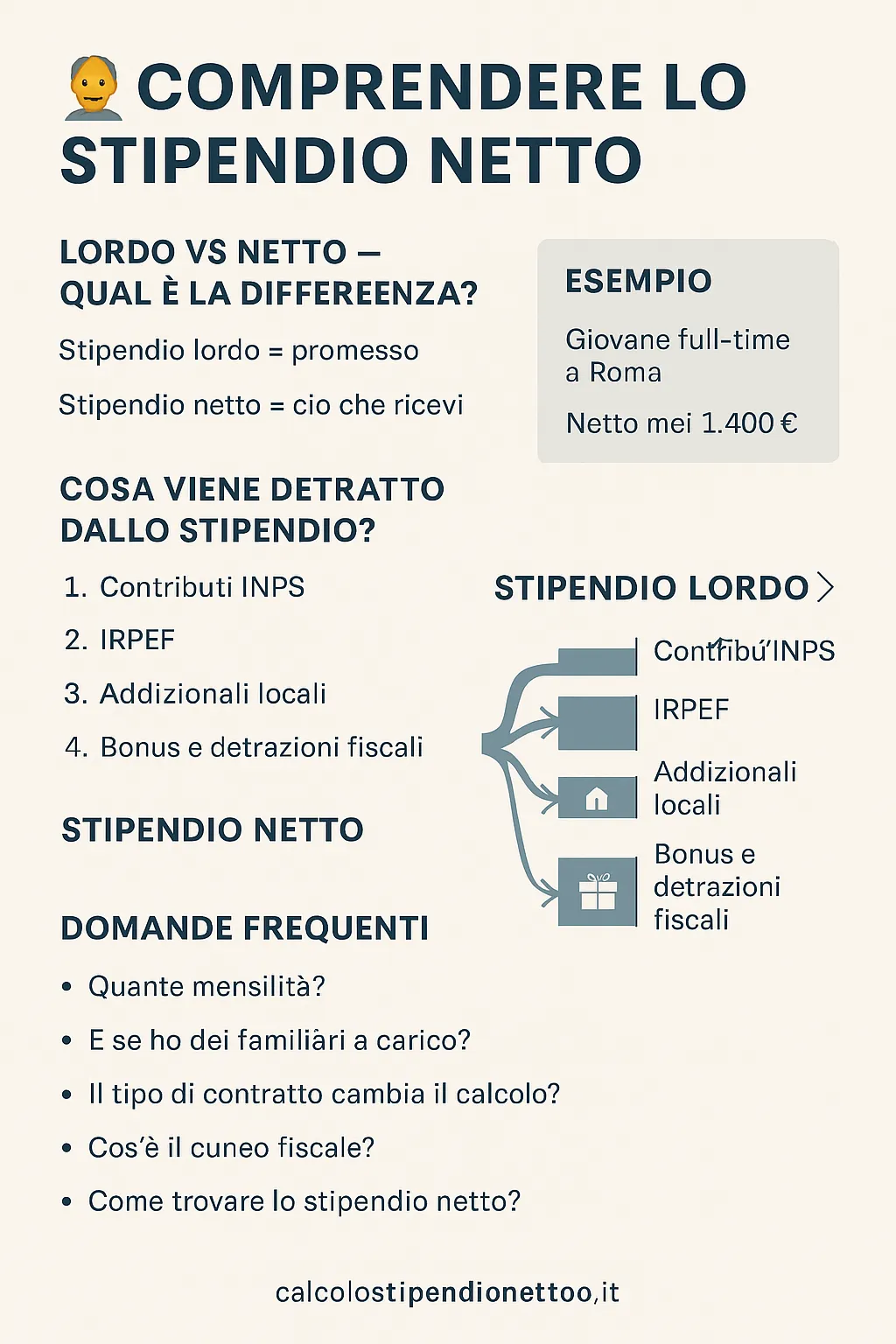

🧾 Lordo vs Netto — Qual è la differenza?

- Stipendio Lordo = “Retribuzione Annua Lorda” (RAL)

→ È l’importo totale promesso dal datore di lavoro, prima delle tasse - Stipendio Netto = Quello che ricevi davvero, dopo tutte le trattenute

Lo stipendio netto è quello che usi ogni giorno: affitto, bollette, spese, risparmi.

Per questo è importante conoscerlo bene.

Cosa viene tolto dal tuo stipendio?

Per passare dal lordo al netto, vengono sottratti:

- Contributi INPS – per pensione e assistenza

→ Circa il 9% - IRPEF (tassa sul reddito) – in base a quanto guadagni

→ Più guadagni = più paghi - Addizionali locali – regionali e comunali (1–3%)

- Bonus e detrazioni fiscali – ti fanno risparmiare sulle tasse

Esempio: Facciamola semplice

Immagina che:

- Guadagni €30.000 lordi all’anno

- Live in Milan

- You have no children

- The contract provides for 13 months’ salary

What’s happening:

- INPS: approximately €2,700

- IRPEF: approximately €4,000

- Local surcharges: approximately €700

- “100 euro” bonus (if applicable): added

➡️ Your monthly net salary will be around €1,750 – €1,800

If you have a child, however, you will pay less taxes and your net income will increase.

And with family or children?

If you have:

- Dependent children

- Spouse without income

- Family members with disabilities

…you can get additional tax deductions

. These lower your IRPEF and increase your net salary.

➡️ With 1 or 2 children, the net income can increase by €100–€300 per month

Part-time and Apprenticeship: does anything change?

- Part-time : everything is proportionate (less hours = less gross = less taxes)

- Apprenticeship : lower INPS contributions (around 5–6%) → slightly higher net salary

New for 2026: Contribution relief

The State has provided a contribution discount for those with lower incomes:

- Under €25,000 gross → 7% INPS discount

- Between €25,000 and €35,000 → 6% discount

The discount is automatic and increases the net by €80–100 per month

Don’t want to do the calculations by hand?

That’s why we created our free online calculator at

👉 calcolostipendionettoo.it

Enter:

- Gross salary

- Region and city

- Contract type (full-time, part-time, apprenticeship)

- Dependent family members

- Number of monthly payments (12, 13 or 14)

And find out your estimated net salary in seconds .

Practical tips to remember

✔️ Always check how many monthly payments the contract provides

✔️ Don’t just compare the gross — count how much you have left

✔️ The family situation and the type of contract make the difference

✔️ Use our calculator to avoid mistakes

Real examples

| Situazione | Stipendio Lordo | Net Monthly |

|---|---|---|

| Giovane full-time a Roma | €24.000 | ~€1,500 |

| Genitore di 2 a Bologna | €30.000 | ~€1,900 |

| Apprendista a Napoli | €22.000 | ~€1,650 |

| Senior a Milano | €45.000 | ~€2,200 |

🏁 Conclusion: Know your worth

Net salary is what really matters — not just what you see written on the contract.

Before you accept an offer, move cities, or plan your expenses, use our calculator to find out how much you’ll really earn each month.